Overview

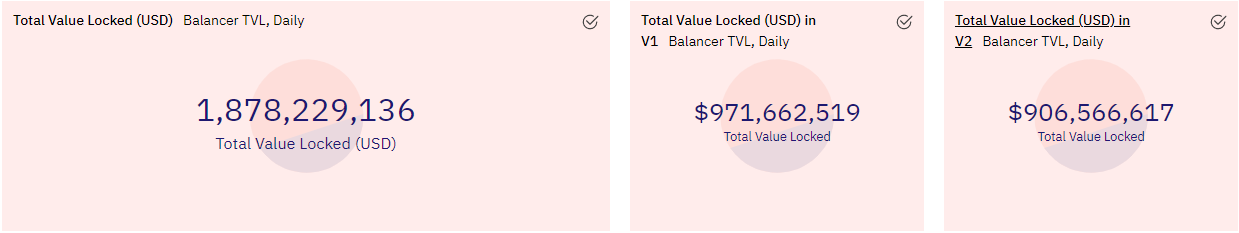

V2 main net TVL surged to a new high of $906M from $763M last week. Polygon TVL also increased significantly to $173M from $122M last week. A bullish market combined with LP’s continuing to trickle in are the primary drivers I think.

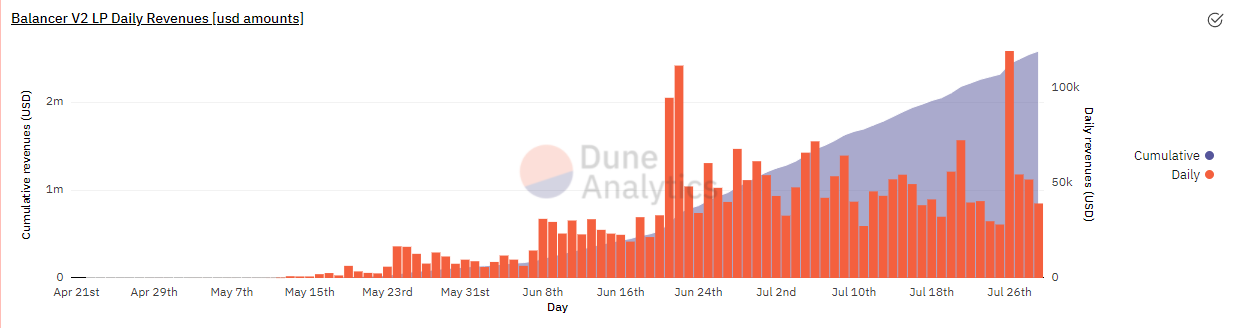

Lifetime swap fees crossed $2.5M this week on main net, with polygon lifetime swap fees sitting at $600k. LP’s are earning around $50k/day in swap fees on average which has been the case since the liquidity mining migration from v1 completed.

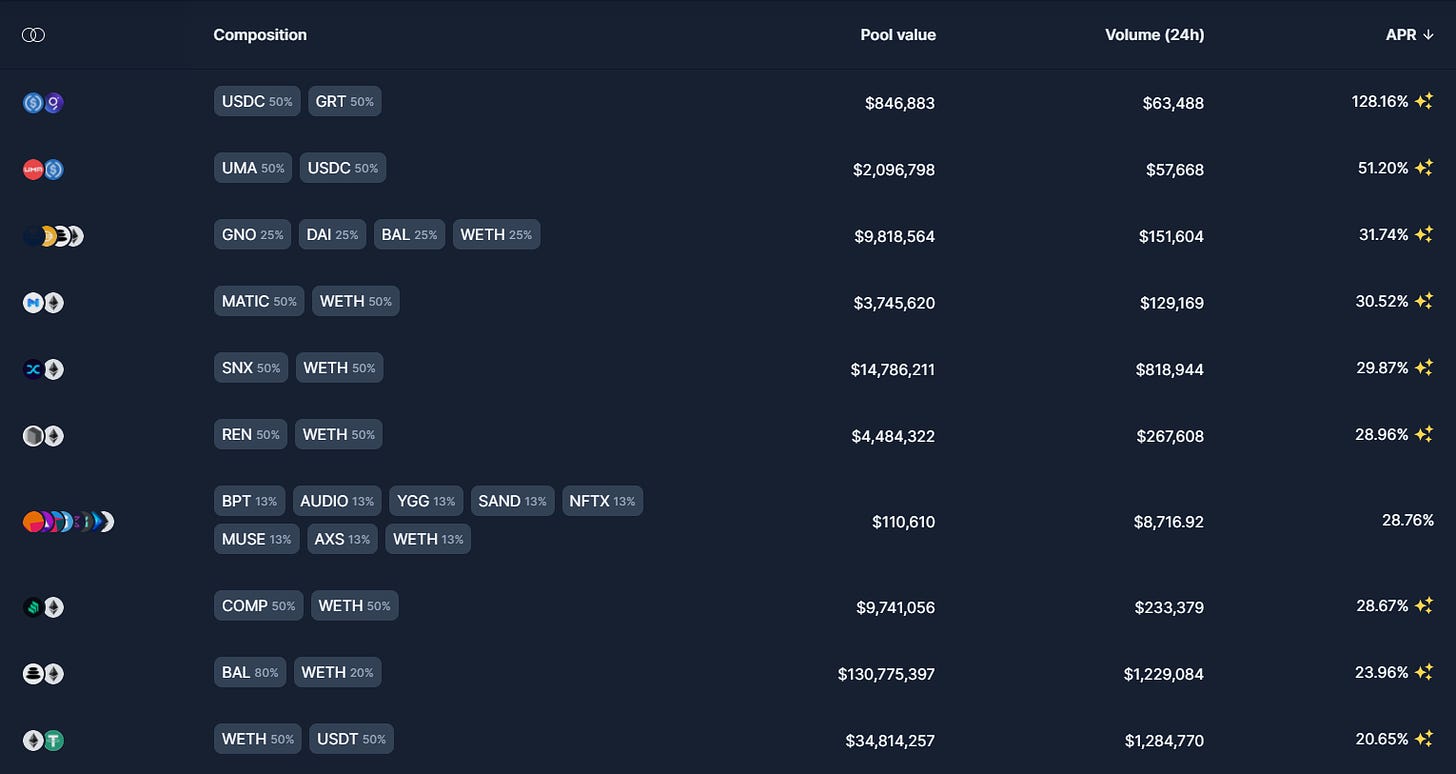

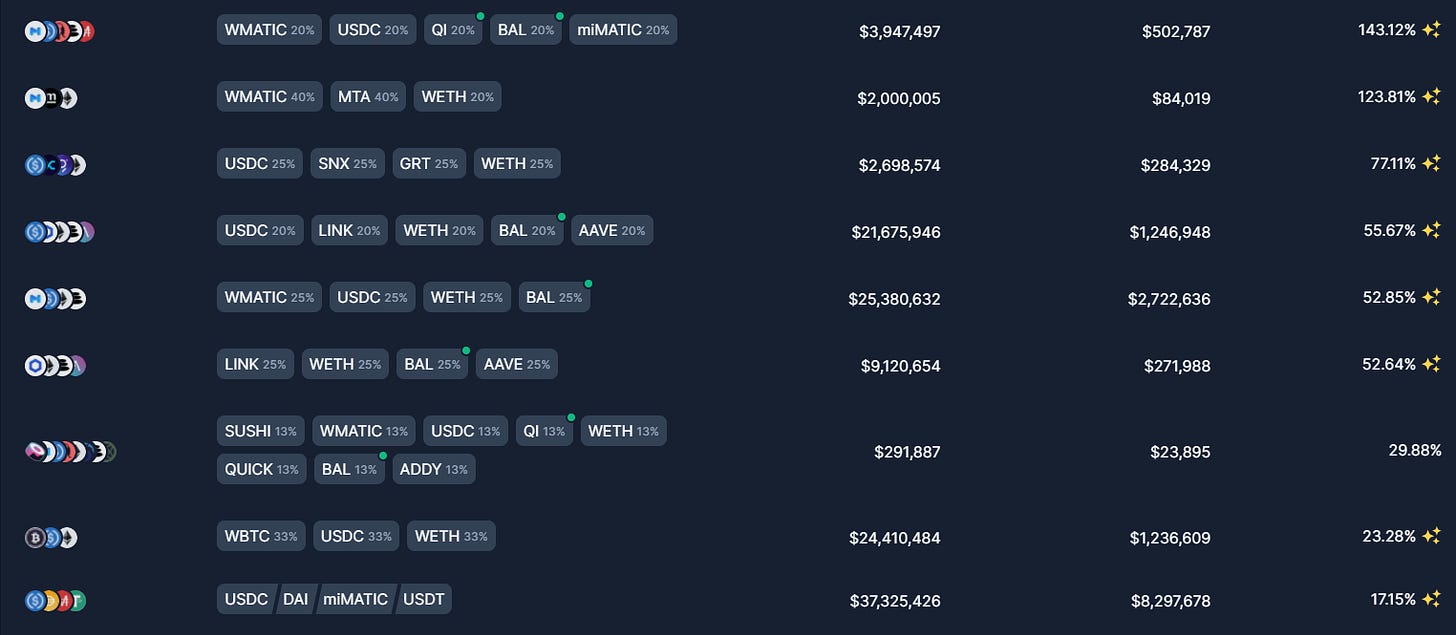

Liquidity Mining

USDC/GRT still sitting comfy at 120% rewards APR, but down significantly from last week’s 240%. Otherwise everything looks in-line with comparable opportunities elsewhere. No changes are planned to main net liquidity mining for next week.

WMATIC/MTA/WETH and USDC/SNX/GRT/WETH saw some new money enter this week which reduced their rewards APR’s a bit, but they remain well above market. Otherwise everything remains largely in line with last week. The big jump in TVL here can be partially attributed to $11M entering the stable pool and someone depositing $23M BAL/WETH liquidity (not shown above as it doesn’t get rewards on polygon).

There is one small change to liquidity mining on polygon for next week - see bakamoto’s spreadsheet for the info.

Ecosystem

mStable announces their incentivized WMATIC/MTA/ETH Balancer pool on polygon

APY Vision now supports Balancer v2 on main net and polygon

Gauntlet pushes another round of dynamic fee updates

Balancer CEO Fernando Martinelli is featured in this Crowdfund Insider article

Balancer Labs tweets these highlights for July

Governance

Baller Bakamoto kicks off a discussion about treasury diversification