Overview

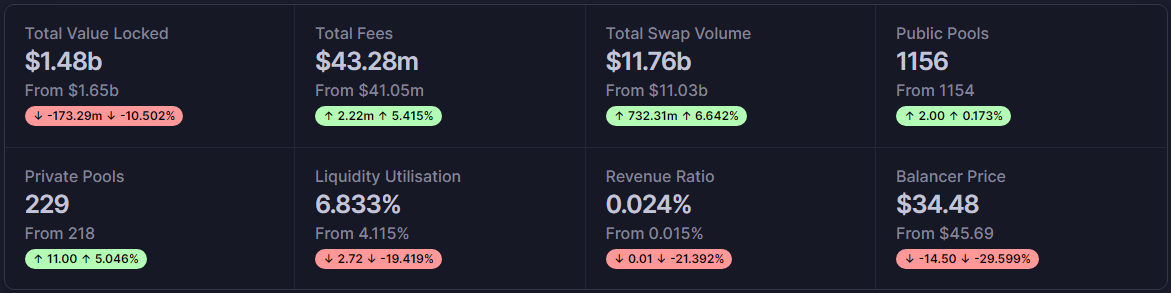

While TVL took a hit due to the broad market correction, it was a strong week for volume & fees. LP’s collected $2.2 million in swap fees on $732 million volume, both of which are new records since the newsletter began.

Incentivized BAL Liquidity Mining

Yield fell around 3% relative to last week as BAL traded lower in line with ETH and BTC. As a result of last week’s governance votes, AAVE’s liquidity mining cap ballooned to $100M which is also a big factor here. GNO’s cap increase was also approved though its liquidity is too small to impact yields. The exchange gas reimbursement program was increased for four more weeks and further improvements/extensions are likely as well.

Balancer v2 Liquidity Mining

There’s been a ton of community input about what the new liquidity mining program could look like - you can read the relevant forum posts here. The current discussion is about deciding how the pools will be organized on a high level. Should we allocate a lot of rewards to Tier 1 pools, or focus more on Tier 2/Tier 3. The real fun begins once we get into the details of what the Tier 2/Tier 3 pools will actually look like. Please feel free to join the discussion if you’re interested.

Ecosystem

Warp.finance receives a Balancer Labs grant for integrating balancer pool tokens as collateral on their platform

Ampleforth has new geysers active, some of which use Balancer

xToken.market has started their liquidity incentives, a few of which utilize Balancer pools.

Radicle’s LBP is currently live - check some stats here

Balancer partners with Aave to build out the first V2 Asset Manager

Bankless has a fireside chat with Fernando & Stani from Aave about Balancer’s partnership with Aave and V2.