The Balancer Report

Every week we share the hottest ecosystem news and cover the most important governance developments. Let's dive in!

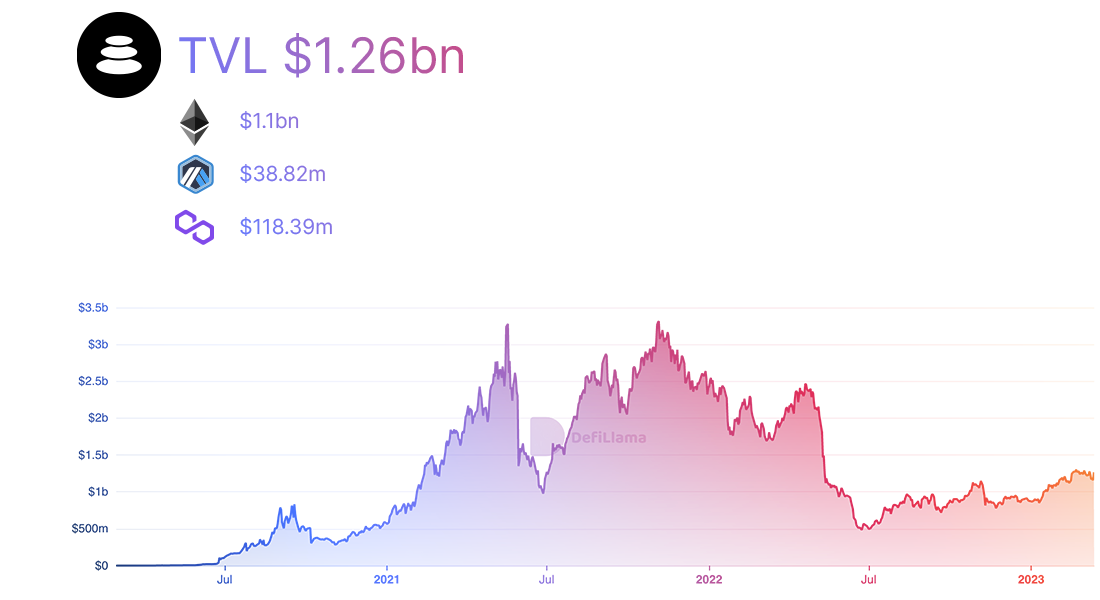

Balancer: TVL and Stats - DefiLlama

Balancer's TVL is $1.26bn. Distributed in the following manner:

The Total Mainnet TVL is $1.10bn and there is an increase of about 2.80% compared to the $1.07bn of the previous week. Being located in the ninth position according to TVL.

The Polygon TVL is at $118.39mm, in which a decrease of 3.08% is verified with respect to the $122.15mm of the previous week. And successfully managed to reach the second position, according to TVL.

Arbitrum TVL is at $38.82mm, registering a decrease of 13.73% compared to the $44.76mm of the last week.

And finally, Balancer on Optimism by Beethoven X sits at $29.14mm TVL.

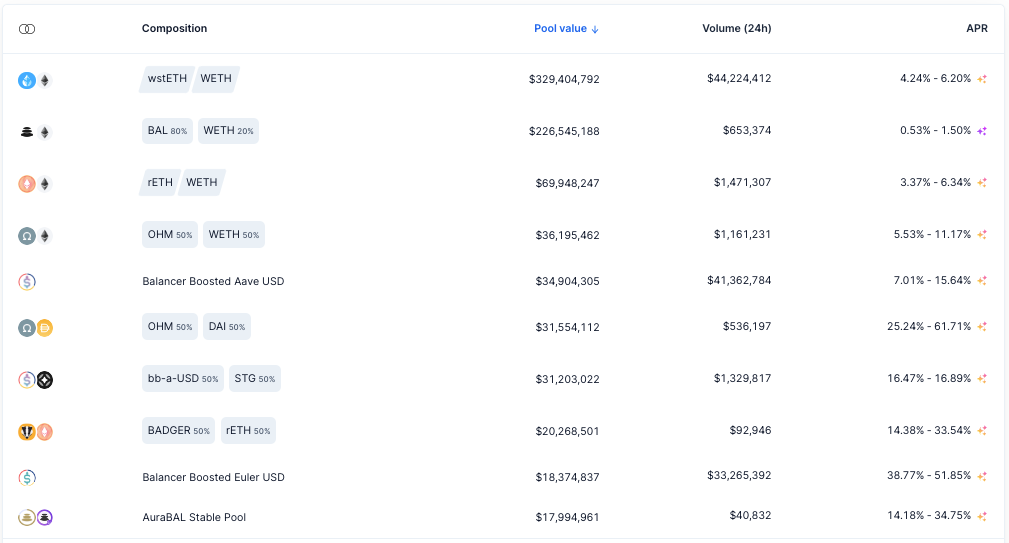

This section will list the top three expected pools to receive most of the next period’s emissions. Voting is open for four more days, and the next period is scheduled to start on Thursday at 00:00 am UTC.

Polygon - 20WETH-80BAL tetuBAL - currently at 17.41%.

Mainnet - wstETH / WETH - currently at 12.61%.

Mainnet - BADGER / rETH - currently at 9.79%.

You can find an overview of the current LM incentives on the Balancer Mainnet below:

Balancer explores the upcoming Shanghai upgrade and what it means for Liquid Staking and the space in general. The thread touches upon Shanghai’s effect on the correlation between LSDs and the amount of staked ETH. It also examines how protocols offering LSDs could benefit from Balancer’s pool architecture in terms of liquidity.

Gyroscope Protocol announces their $4,5m raise led by Placeholder and Galaxy. Fernando took part in the round as an angel investor.

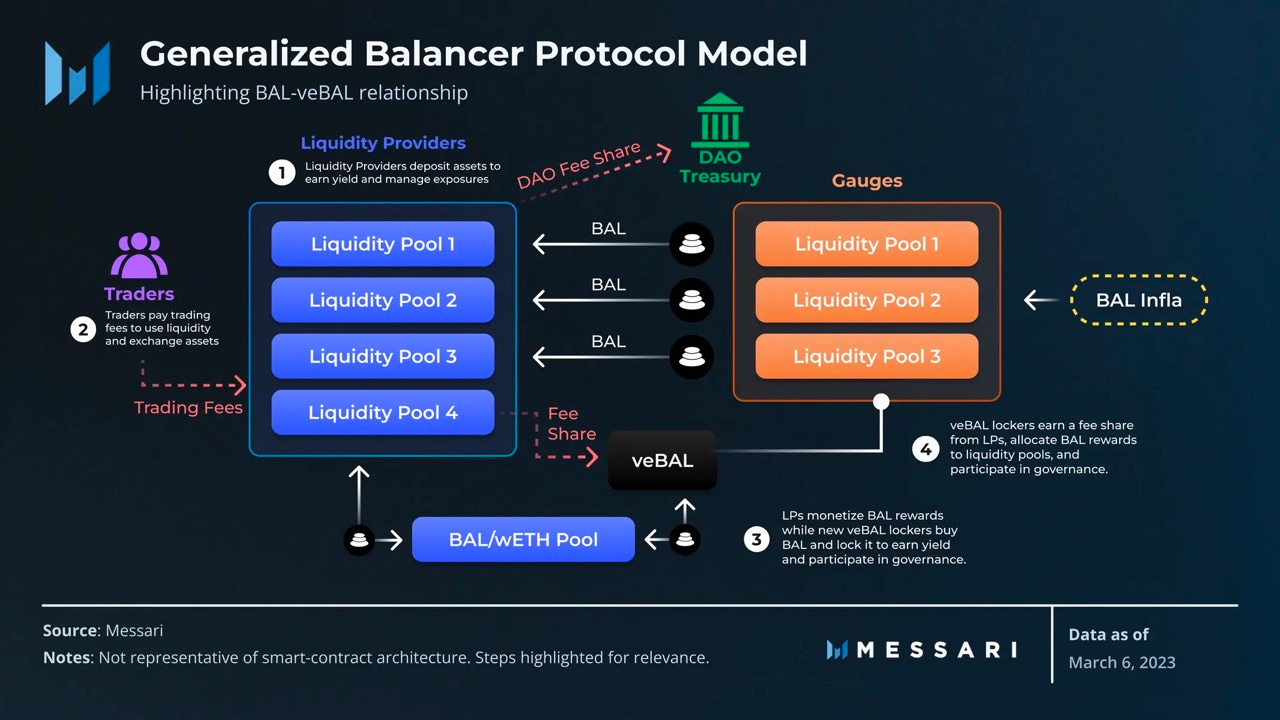

Gyro is building an “all-weather reserve” stablecoin backed by a basket of tokens. The system aims to maximize resilience by minimizing the price impact of any individual asset’s price changes. Gyro proto is live on: https://app.gyro.finance/Messari looks into the relationship between BAL’s escrow yield and Balancer’s vote escrow tokenomics.

The thread highlights some of the veBAL locking benefits that lockers can benefit from: “a share of trading fees paid to other liquidity pools; the ability to vote: the ability to direct BAL inflation rewards”.

Those looking for an even deeper dive could find the full report authored by Johnny_TVL on this page.Lido’s wstETH comes to Polygon.

This continues their L2 expansion and the decision was based on “parameters incl network TVL, DeFi activity, security and the presence of many long-term Lido partners”

Polygon also created a native bridge route to facilitate wstETH bridnging, you can find more details here.Gnosis DAO hosted a Twitter space to mark Balancer’s Gnosis Chain launch.

Tritium and Gleb joined the stage to chat about Boosted pools and how the new deployment aims to make DeFi even more accessible on leading L2 solutions.Tim shared the latest update on Ethereum Staking Deposits.

The total number of depositor addresses is nearing 100,000. Balancer remains the largest holder of rETH for RocketPool and maintains its leading positions when it comes to Frax Finance and Lido.Here are the current bribes on HiddenHand. The round ends on March 9, 2023.

Last week saw 4 Snapshot votes:

[BIP-207] Grant Balancer Maxis the authorisation to register protocolIds for LinearPools

[BIP-208] Enable Overnight Pulse Gauge [Arbitrum]

[BIP-209] Enable ALCX/ETH (80/20) Gauge on Ethereum

[BIP-210] Deprecate Old Stargate Gauges & Add Gauges for STG v2

Balancer has a flourishing ecosystem. You’re welcome to contribute to it whether you’re a dev, a community person, or a graphic designer! We strive toward onboarding every new member in a smooth and personalized way.

Join the Ballers and start your Balancer journey now: http://discord.balancer.fi/

Are you looking for a grant? Learn more here.

If you speak Spanish, make sure you give Balancer Español a follow. And if you speak Portuguese, follow Balancer Brasil.