Overview

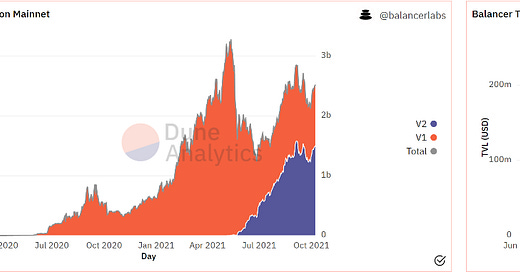

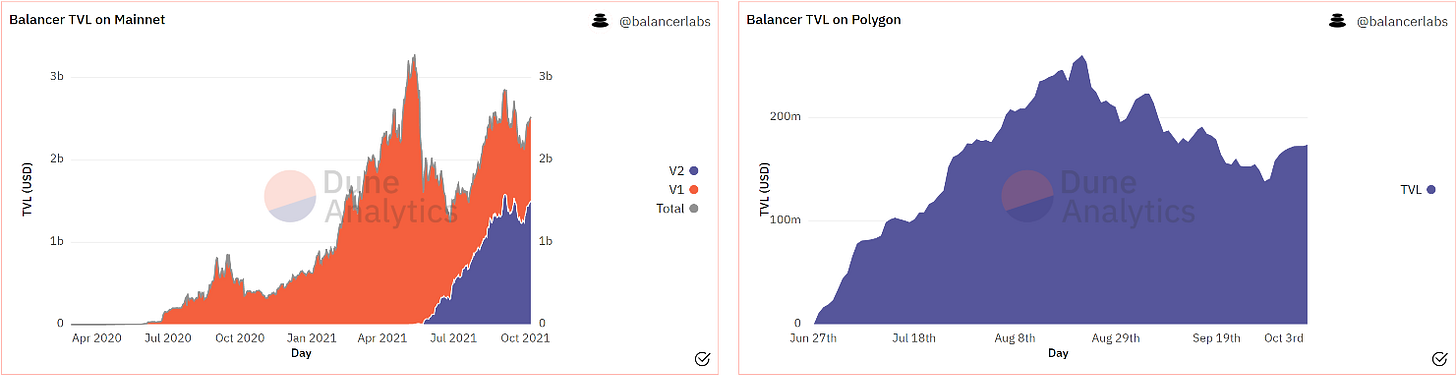

Following the market’s recovery this week, mainnet v2 TVL rose to $1.5B from $1.33B last week, just a bit shy of the all time high at $1.57B. Polygon’s TVL surged from $144M to $174M and Arbitrum continued it’s upward momentum, now sitting at $93.7M from $76M last week.

Despite mainnet v2 TVL being near all time highs, daily LP revenue is hovering at the same levels as when TVL was 50% lower. There isn’t any focus on optimizing for LP revenue at the moment so can’t read much into it. A lot of TVL sits in the stable pools that see very little trading volume so that’s the main reason.

Liquidity Mining

Checking in on Polygon this week where there are some solid opportunities for prospective farmers. Rotation of BAL incentives from multi-asset pools to two token pools continues with the goal of boosting TVL. You can check on Bakamoto’s spreadsheet for a look at Monday’s changes.

Ecosystem

Earn a fixed yield rate on your BAL with 88mph

Gauntlet pushed another round of dynamic fee updates

Balancer Labs highlights Element Finance’s use of Balancer V2 for flexibility and custom trading curves

Gerg from Balancer Labs posts another community update

Gro Protocol deploys an 80/20 pool after their recent LBP

Balancer v2 plays a big role in the upcoming Fei Protocol v2

Tempus announces the launch of their testnet - tune in for their AMA in Balancer discord on Monday.

How to use your BAL without spending it, featuring QiDAO.

Balancer Grants DAO publishes a big monthly update as their second month comes to an end.