Overview

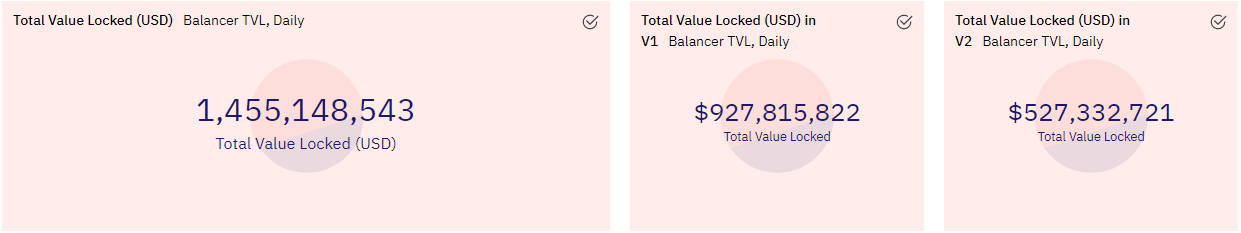

With the liquidity mining migration coming to an end this past week, v2 TVL surged from $337M last week to $527M currently. On polygon, we’ve just crossed $30M TVL with over $19M lifetime volume.

Liquidity Mining

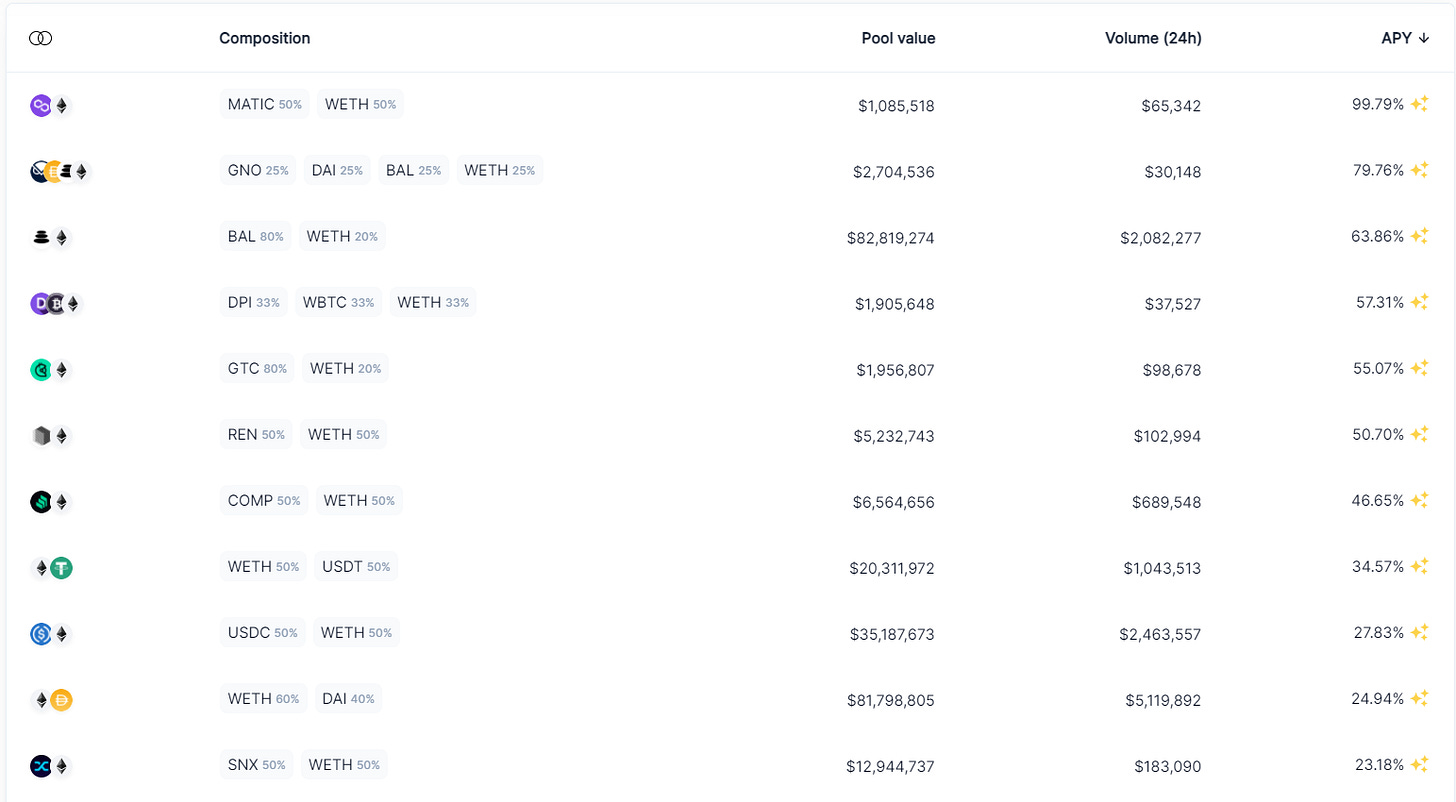

On main net the story is the same as last week, with the more recent additions still sporting above market rewards APY’s. Most likely explanation is it takes time for people to browse the site and realize we’ve added new stuff - plus not everyone knows you have to click “Load More” at the bottom once or twice before sorting by APY becomes accurate.

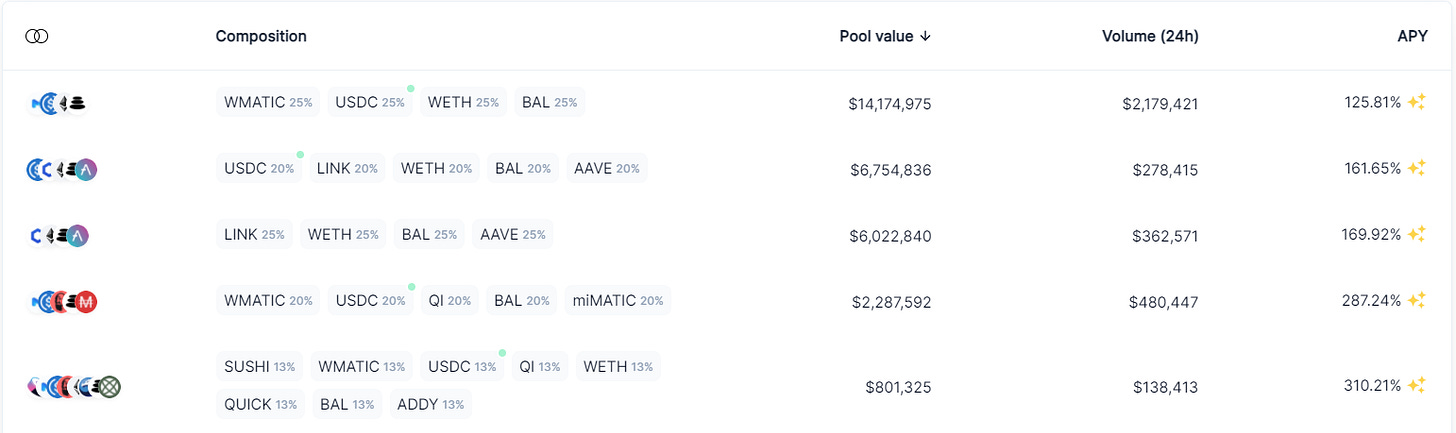

On polygon every pool still offers more than 100% rewards APY (this number reflects BAL+MATIC ,+QI where applicable). The most interesting thing to me is the pools with only eth/blue chip defi exposure still have rewards APY in the 140-160% range, far higher than any comparable yield on main net. For now we can probably chalk this up to lack of awareness - we’ll see what changes next week and perhaps discuss some other factors that might be at play.

For an overview of next week’s changes, see bakamoto’s spreadsheet.

Ecosystem

Balancer’s official polygon launch announcement

0x API now supports Balancer’s liquidity on polygon

OpenDeFi discusses treasury management using Balancer smart pools

Balancer Labs is hiring for a Partnership Lead position

Governance

Stefano Bury from LongHash Ventures proposes the staking of BAL for Economic and Governance Benefits

Baller Bakamoto asks for input on what is Balancer’s current primary objective

Community Volunteer Andrea offers observations on the current state of Balancer