Overview

As markets continued their recovery after last week’s decline, mainnet v2 TVL is back near all time highs at $1.52B from $1.41B last week. On polygon, TVL continued falling to $177M from $188M last week. The most likely explanation is the hangover effect of MATIC rewards ending combined with a heavier weighting on non-ETH assets which have lagged ETH over the last month.

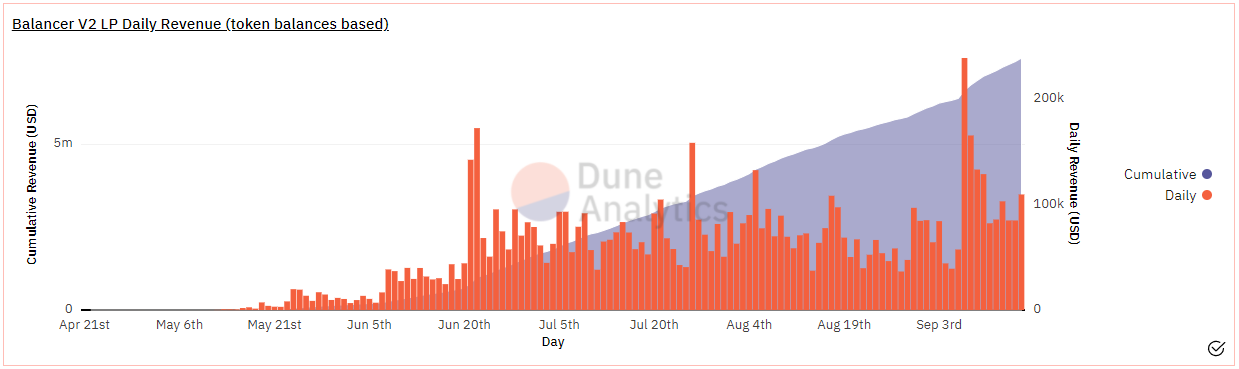

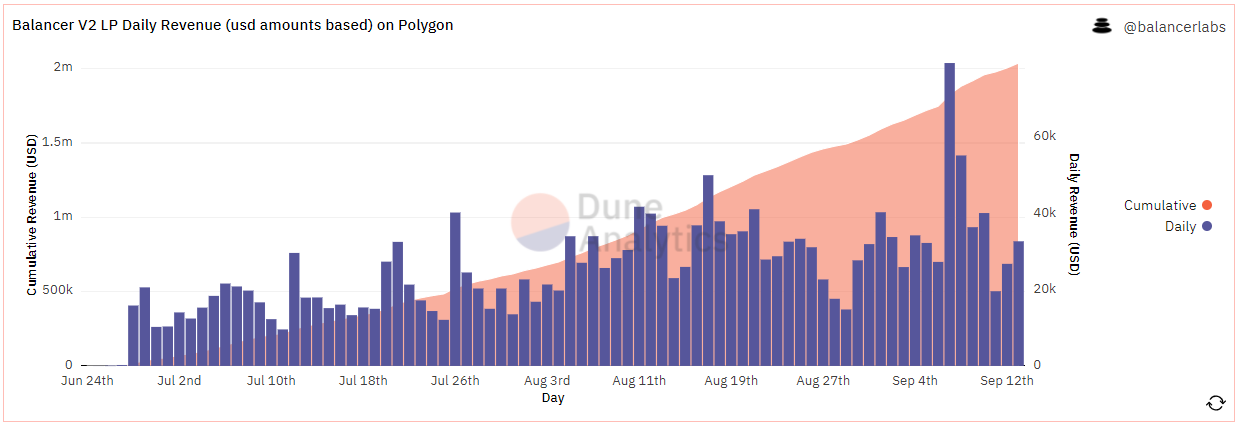

Last Monday’s shock move lower seems to be having a lasting effect on mainnet LP revenues. The average daily revenue is hovering near the $100k area which represents a substantial increase from July and August averages. On polygon, the decreasing TVL does not seem to be impacting LP revenues much yet as daily numbers remain in line with August so far.

Liquidity Mining

That 776% at the top is accurate - that’s one of the first LBP launches on v2 using the newly released Copper UI. The aKLIMA chads decided to use 2.5% swap fee and you can see the resulting fat swap fee APR. In other news, several more pools are being added on Arbitrum for BAL rewards so be sure to check Bakamoto’s spreadsheet if you’re interested.

Ecosystem

Copper v2 launches with support for LBP’s on Balancer v2 mainnet

Bluewind Media is now consulting for Balancer Labs to help with developer outreach

Gauntlet pushes another round of fee updates for dynamic fee pools

Fernando spots the first flash swap arbitrage bot using Balancer v2

Gerg from Balancer Labs writes another great community update

Paraswap integrates Balancer v2 liquidity

KlimaDAO completes the first Fair Launch Auction using Copper

Governance

Voting is live to extend BAL rewards for AAVE/WETH stakers until January 20th, 2022.

Voting is live to authorize Gauntlet to manage MetaStable and Stable pools (swap fee and amplification factor)