The Balancer Report

Every week we share the latest ecosystem news and cover the most important governance developments. Let's dive in!

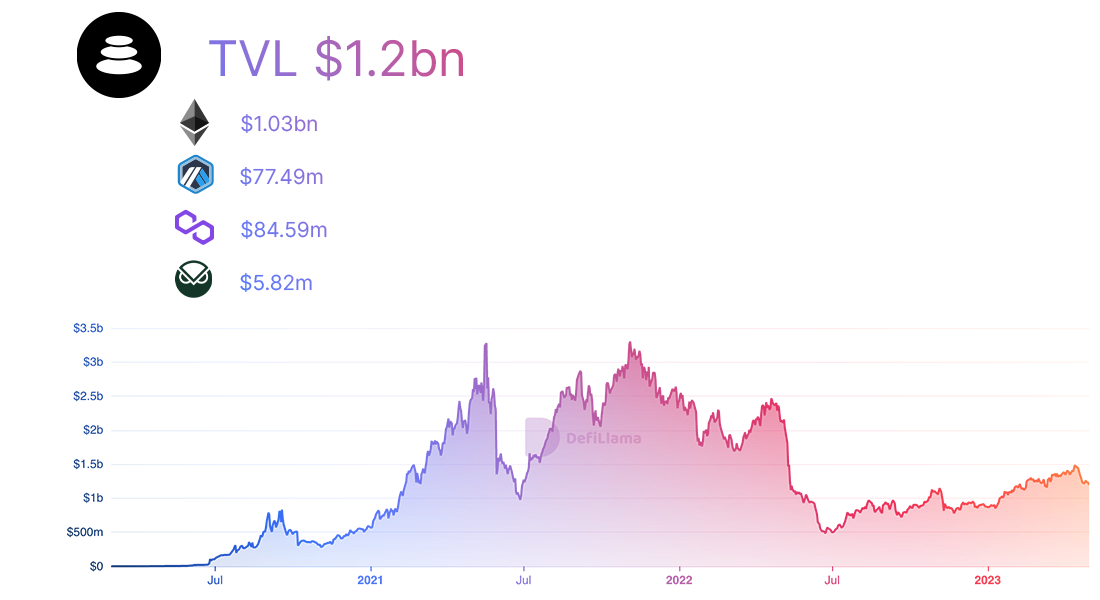

Balancer: TVL and Stats - DefiLlama

Balancer's TVL is $1.20bn. Distributed in the following manner:

The Total Mainnet TVL is $1.03bn and there is a decrease of about 1.90% compared to the $1.05bn of the previous week. Being located in the twelfth position according to TVL.

The Polygon TVL is at $84.59mm, in which a decrease of 13.90% is verified with respect to the $98.25mm of the previous week. Being in the fourth position according to TVL.

Arbitrum TVL is at $77.49mm, registering an increase of 1.67% compared to the $76.21mm of the last week.

The Gnosis TVL is at $5.82mm, that is, a 16,63% increase compared to the $4.99mm of the previous week.

And finally, Balancer on Optimism by Beethoven X sits at $46.35mm TVL.

As for our liquid wrappers, they are under the following parity to veBAL:

Aave’s V3 boosted pools are live on Polygon and Arbitrum! The pools that hold LSTs such as $rETH utilize Balancer’s tech and pair it with Aave’s infrastructure in order to get the idle part of the liquidity moving for an extra boost.

The deployment is in line with Balancer’s ongoing L2 expansion and highlights the versatility of the available pool types.

You can read more about boosted pools in the docsBeethoven X takes a deep dive into the second iteration of Boosted Pools aka Boosted Pools V2.

Just like regular boosted pools, V2 puts underlying liquidity to work although in this case the process is powered by Reaper Farm’ multi-strategy vaults which Include USDT, DAI, WBTC, wFTM and more.

Beethoven X also highlights the net positive impact they expect the deployment to have on their cashflow stability.

Aura shares a thread recapping their recent developments.

These include onboarding unshETH, Swell and Bitfrost into the Balancer ecosystem, Aura’s new proposal in Aave’s governance forum and a new vETH gauge vote.

In other news, the protocol saw over 130k new auraBAL minted in the month of April.Ankr is planning to expand to Fantom in a move which aligns with their vision that centers around making DeFi accessible to all.

The latest blog post covers the basics of liquid staking as well as Ankr’s reasons for expanding to Fantom and highlights Beethoven X’s wFTM/ankrFTM pool which is live on Beets Finance.Aura Finance contributors Mui and Lamentations outlined their vision for the future of Balancer’s marketing efforts and brand positioning.

Their forum post focuses on the visual style and proposes a new aesthetic alongside an updated color palette.

BeethovenX contributors Vee, Jedi and Naaly also weighed in on the topic and elaborated on their own vision.

The Balancer ecosystem thrives thanks to its active contributor community and everyone is welcome to participate in the ongoing forum discussion.Cosme Fulanito joined Stader’s Twitter space to talk about Balancer’s origins and explore the different pool types that are available.

Check the recording out if you speak Spanish!Kassandra DAO, a Balancer grantee, rolled out their pool creation interface that aims to make pool creation and management smooth and simple.

In their own words: “Building pools to us wasn't just about making creating them possible, but delivering the best possible user experience while doing it.”

They’re planning to launch Polygon pool creation in the near future.Swell goes live on the mainnet through their public beta which is open to everyone. Their future plans include progressive decentralization and you can follow their journey on Twitter.

Balancer is joining Swell’s upcoming AMA on May 3, don’t miss out!Here are the current bribes on HiddenHand. The round ends on May 4, 2023.

This section will list the top three expected pools to receive most of the next period’s emissions. Voting is open for four more days, and the next period is scheduled to start on Thursday at 00:00 am UTC.

Mainnet - OHM / DAI - currently at 10.89%.

Mainnet - wstETH / COMP - currently at 9.81%.

Mainnet - wstETH / WETH - currently at 9.80%.

You can find an overview of the current LM incentives on the Balancer Mainnet below:

Last week saw 8 Snapshot votes with all of them being approved:

[BIP-268] Enable non-BAL reward tokens on new L2 gauges

[BIP-269] Enable vETH stableswap gauge [Ethereum]

[BIP-270] Enable baoUSD/LUSD gauge w/2% cap [Ethereum]

[BIP-271] Enable LUCHA/wMATIC Gauge [Polygon]

[BIP-272] Weighted Pool v1 Permission Granting

[BIP-273] Permissions Preset Update Request #1

[BIP-274] Enable wstETH/rETH Gauge and kill old gauge [Ethereum]

[BIP-275] Request to Compensate Contributors in Liquid BAL

This week Dubstard delivered his usual monthly report, do not miss it here.

And he also brings another set of warnings:

People inviting you to “support servers” are scammers:

Avoid clicking on any “airdrop’ links in people’s Discord bios / messages:

There are no “BAL exploits”, this scam aims to take advantage of people’s urge to secure their assets:

Do not click on any links that mention something similar to what the screenshot above illustrates

Remember, Balancer Labs operates primarily under the following domain:

https://balancer.fi/

Balancer has a flourishing ecosystem. You’re welcome to contribute to it whether you’re a dev, a community person, or a graphic designer! We strive toward onboarding every new member in a smooth and personalized way.

Join the Ballers and start your Balancer journey now: http://discord.balancer.fi/

Are you looking for a grant? Learn more here.

If you speak Spanish, make sure you give Balancer Español a follow. And if you speak Portuguese, follow Balancer Brasil.

This article is for informational and educational purposes only. It should not be construed as investment or trading advice or a solicitation or recommendation to buy, sell, or hold any digital assets. Transactions on the blockchain are speculative. Carefully consider and accept all risks before taking action.